Protect Your Portfolio: A Comprehensive Guide to Market Crash Survival

How to protect your portfolio from market crashes involves diversifying investments, setting stop-loss orders, maintaining a cash reserve, and regularly rebalancing your portfolio to align with your risk tolerance and financial goals.

Navigating the stock market can feel like sailing through unpredictable seas. While the potential for growth is enticing, the looming threat of market crashes can leave investors feeling anxious. This comprehensive guide provides actionable strategies on how to protect your portfolio from market crashes, ensuring you’re prepared to weather any storm.

Understanding Market Crashes and Their Impact

Market crashes are sudden, significant declines in stock prices, typically triggered by economic shocks, investor panic, or geopolitical events. Understanding the nature of these crashes and their potential impacts is the first step in protecting your portfolio.

What Causes Market Crashes?

Market crashes are rarely caused by a single event. Instead, they are often the result of a combination of factors that create a perfect storm of economic uncertainty and investor fear.

The Ripple Effect of Market Crashes

The impact of a market crash extends beyond immediate financial losses. It can affect investor confidence, economic growth, and even employment rates.

- Reduced Investor Confidence: Crashes can erode investor confidence, leading to a decrease in market participation and further price declines.

- Economic Slowdown: A sharp decline in the stock market can trigger an economic slowdown as businesses reduce investments and consumers cut back on spending.

- Job Losses: Companies may be forced to lay off employees in response to decreased revenue and market instability.

Understanding the causes and ripple effects of market crashes provides a foundation for implementing effective protective strategies. A proactive approach can help mitigate potential losses and safeguard your financial future.

Diversification: Your First Line of Defense

Diversification is a cornerstone of risk management. By spreading your investments across various asset classes, industries, and geographic regions, you can reduce the impact of any single investment performing poorly.

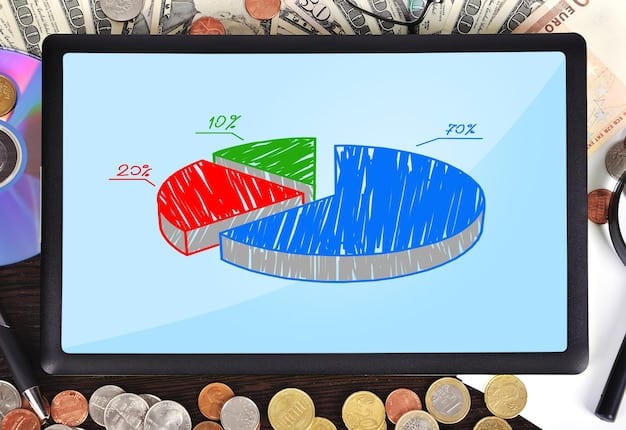

The Power of Asset Allocation

Asset allocation involves dividing your portfolio among different asset classes, such as stocks, bonds, and real estate, based on your risk tolerance and investment goals.

Diversifying Within Asset Classes

Beyond asset allocation, it’s crucial to diversify within each asset class. For example, within the stock market, consider investing in companies of different sizes (large-cap, mid-cap, small-cap) and industries.

- Stocks: Include a mix of growth stocks, value stocks, and dividend-paying stocks to balance potential returns and risk.

- Bonds: Invest in a variety of bonds with different maturities to reduce interest rate risk.

- Real Estate: Consider investing in real estate through REITs (Real Estate Investment Trusts) to diversify your portfolio.

Diversification is not a foolproof strategy, but it can significantly reduce the volatility of your portfolio and protect it from severe losses during market downturns.

Setting Stop-Loss Orders: Limiting Your Losses

Stop-loss orders are an essential tool for managing risk. They automatically sell a security when it reaches a specified price, helping to limit potential losses in a declining market.

How Stop-Loss Orders Work

A stop-loss order is placed with a broker to sell a security when it reaches a predetermined price. This price is typically set below the current market price to protect against losses.

Types of Stop-Loss Orders

There are several types of stop-loss orders, each with its own advantages and disadvantages.

- Market Stop-Loss Order: This type of order sells the security at the best available price once the stop price is reached.

- Limit Stop-Loss Order: This order sells the security at a specified price or better, providing more control but also the risk of not being executed.

- Trailing Stop-Loss Order: This order adjusts the stop price as the security’s price increases, allowing you to capture profits while still protecting against losses.

Implementing stop-loss orders requires careful consideration of your risk tolerance and the volatility of the securities in your portfolio. While they can help limit losses, they can also be triggered by short-term market fluctuations.

Maintaining a Cash Reserve: The Importance of Liquidity

Having a readily available cash reserve is crucial for navigating market crashes. This cash can be used to cover expenses, take advantage of buying opportunities, and avoid selling investments at a loss.

Why a Cash Reserve Matters

A cash reserve provides financial flexibility and peace of mind during uncertain times. It allows you to avoid panic selling and potentially profit from market rebounds.

Determining the Right Amount of Cash

The ideal amount of cash to keep on hand depends on your individual circumstances, including your income, expenses, and risk tolerance.

- Emergency Fund: Aim to have 3-6 months’ worth of living expenses in a readily accessible savings account.

- Investment Opportunities: Set aside additional cash to take advantage of undervalued assets during market downturns.

- Avoiding Forced Sales: Ensure you have enough cash to avoid selling investments at a loss to cover unexpected expenses.

Maintaining a cash reserve is a fundamental aspect of financial preparedness. It provides a safety net that can help you weather market volatility and achieve your long-term financial goals.

Rebalancing Your Portfolio: Staying on Track

Rebalancing involves adjusting your portfolio to maintain your desired asset allocation. This process helps ensure that your portfolio remains aligned with your risk tolerance and investment goals.

The Benefits of Rebalancing

Over time, your portfolio’s asset allocation can drift due to market fluctuations. Rebalancing helps you buy low and sell high, potentially improving your returns and reducing risk.

How to Rebalance Your Portfolio

Rebalancing typically involves selling assets that have increased in value and buying assets that have decreased in value to bring your portfolio back to its target allocation.

- Determine Your Target Allocation: Establish your desired allocation based on your risk tolerance and investment goals.

- Regularly Review Your Portfolio: Monitor your portfolio’s performance and asset allocation on a quarterly or annual basis.

- Implement Rebalancing Strategies: Use strategies such as calendar rebalancing or threshold rebalancing to maintain your desired allocation.

Rebalancing is an ongoing process that requires discipline and a long-term perspective. By regularly rebalancing your portfolio, you can stay on track to achieve your financial objectives and protect your investments from market volatility.

Staying Informed and Avoiding Panic

One of the most important aspects on how to protect your portfolio from market crashes is avoiding panicked decisions. Staying informed about market trends and economic conditions can help you make rational investment choices rather than reacting emotionally to short-term fluctuations.

Reliable Sources of Information

In the age of information overload, it’s crucial to rely on reputable sources when gathering financial news and advice.

The Dangers of Emotional Investing

Fear and greed can drive investors to make irrational decisions, such as selling low during a market crash or buying high during a bubble. Maintain a disciplined approach and avoid letting emotions dictate your investment strategy.

- Avoid Herd Mentality: Resist the urge to follow the crowd and make investment decisions based on popular trends.

- Long-Term Perspective: Focus on your long-term financial goals and avoid getting caught up in short-term market noise.

- Seek Professional Advice: Consult with a financial advisor to get unbiased guidance and develop a sound investment strategy.

Staying informed and avoiding panic are essential for successful long-term investing. By maintaining a rational approach and focusing on your financial goals, you can navigate market volatility with confidence.

| Key Point | Brief Description |

|---|---|

| 🛡️ Diversification | Spread investments across various assets to reduce risk. |

| 🛑 Stop-Loss Orders | Limit potential losses by automatically selling securities at a specified price. |

| 💰 Cash Reserve | Maintain liquidity for expenses and investment opportunities. |

| ⚖️ Rebalancing | Adjust portfolio to maintain desired asset allocation. |

Frequently Asked Questions (FAQ)

▼

A market crash is a significant and sudden drop in stock prices, typically driven by economic shocks, investor panic, or geopolitical events. It often leads to widespread financial losses and economic uncertainty.

▼

Diversification reduces risk by spreading your investments across various asset classes, industries, and regions. If one investment performs poorly, the impact on your overall portfolio is minimized.

▼

A stop-loss order is an instruction to your broker to automatically sell a security when it reaches a specified price. This helps limit potential losses by selling before further declines occur.

▼

A cash reserve provides liquidity, allowing you to cover expenses, take advantage of buying opportunities, and avoid selling investments at a loss during market downturns. It offers financial flexibility.

▼

Rebalance your portfolio regularly, typically quarterly or annually, to maintain your desired asset allocation. This involves selling assets that have increased and buying those that have decreased in value.

Conclusion

Protecting your portfolio from market crashes requires a proactive and disciplined approach. By diversifying your investments, setting stop-loss orders, maintaining a cash reserve, rebalancing your portfolio, and staying informed, you can mitigate potential losses and navigate market volatility with greater confidence. Remember, long-term financial success often relies on weathering the storms with a well-prepared strategy.