Analyzing Real Estate Market Trends: Spotting Opportunities

Analyzing market trends is crucial in real estate to effectively identify emerging opportunities, anticipate shifts, and make well-informed investment decisions.

Are you looking to get into the real estate market or grow your current investment portfolio? Then mastering the art of analyzing market trends: identifying emerging opportunities in the real estate sector is crucial to success. By understanding current trends, you can unlock the path to informed decisions, maximize potential returns, and minimize your risk.

Decoding real estate market dynamics

The real estate market is constantly changing due to economic policies, demographics, and technological advancements.

Understanding these dynamics is essential before making any investment decisions.

The influence of economic indicators

Economic indicators can provide valuable insights into the health of the real estate market. Let’s take a look at some of the most relevant ones.

- Gross Domestic Product (GDP): A growing GDP typically signals a strong economy, leading to increased property values and demand.

- Interest rates: Lower interest rates encourage borrowing, increasing home purchases and investments.

- Unemployment rates: Low unemployment rates mean more people have disposable income, driving demand for housing.

Keeping an eye on these indicators can help you anticipate market movements and make better investment choices.

By tracking key metrics, you can stay ahead of potential shifts and capitalize on emerging opportunities. Remember that economic indicators reflect future market conditions.

Demographic shifts and housing needs

Demographic changes play a huge role in shaping housing needs and preferences. As different generations move through life stages, their housing priorities evolve, creating unique market opportunities.

Generational trends in housing

Each generation brings its own set of preferences and expectations. Knowing these trends can help us anticipate future demand.

- Baby Boomers: Many boomers are downsizing, looking for smaller homes in retirement communities or urban areas.

- Millennials: Prefer urban living and condo type units, and are interested in environmentally sustainable features.

- Generation Z: Entering the market, they are prioritizing affordability and convenience, often opting for smaller, shared spaces.

Consider how these demographic trends can influence your investment strategy and market choices.

Understanding these trends in turn, would inform future housing developments and identify areas with unmet needs. By watching these shifts, you can identify undervalued properties that are poised for growth.

The impact of technological advances

Technology is changing the real estate industry, and the traditional way investors conduct business. From smart home technologies to online platforms, many new opportunities have come up from technological advances.

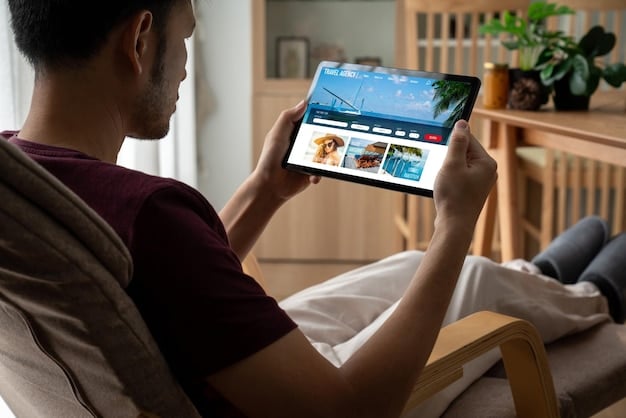

Digital platforms and market access

Online platforms have revolutionized the way properties are bought, sold, and managed. There have multiple gains from leveraging on technological advances.

- Online Listings: Sites like Zillow and Realtor.com provide extensive property data, market insights, and comparative analyses.

- Virtual Tours: Allow potential buyers to walk through properties remotely, expanding the reach and efficiency of showings.

- Data Analytics: Tools now offer detailed analytics on market trends, property values, and investment potential.

Use these digital tools will improve efficiency, transparency, and access to information. Digital platforms help investors and buyers to connect very easily.

By integrating technology into your real estate strategy, you can streamline operations, maximize returns, and stay ahead in a competitive market.

Identifying niche markets for investment

Niche markets can offer significant opportunities for investors who are willing to specialize and cater to specific needs. Identifying these markets requires research and a deep understanding of local dynamics.

Specialized living communities

Specialized living communities are designed to meet the needs of specific demographic groups.

- Senior Housing: Retirement communities with healthcare and recreational facilities have become increasingly popular.

- Student Housing: Properties near universities, offering amenities tailored to student life.

- Eco-Friendly Homes: Properties emphasizing sustainable building materials, energy efficiency, and green living.

These housing segments provide opportunities for investors who want to cater to underserved populations. Specialized living communities meet the unique requirements and demands of their residents and create a sense of belonging.

Focusing on niche markets can provide higher returns and lower competition.

Sustainable and eco-friendly real estate

Sustainable and eco-friendly real estate is on the rise because of how people are aware of environmental impacts, increasing the willingness for buyers and buyers. Embracing sustainable practices can lead not only to environmental benefits but also to financial gains.

Benefits of green buildings

Green buildings offer a wide range of advantages for owners, tenants, and the environment.

- Energy Efficiency: Properties with solar panels, energy-efficient appliances, and smart home technology reduce operational costs.

- Water Conservation: Rainwater harvesting systems, low-flow fixtures, and drought-resistant landscaping lower utility bills.

- Healthy Living: Improved indoor air quality through ventilation systems and non-toxic materials enhance the health and well-being of residents.

Investing in sustainable real estate aligns with global trends and positions you as a responsible and forward-thinking investor.

Look for properties with green certifications and energy efficient technologies to improve appeal and value.

Strategies for risk mitigation

The real estate market presents risks, but effective risk mitigation strategies can protect your investments and ensure long-term success. Diversification, property management, and insurance coverage are all crucial components of a robust risk management plan.

Diversification and portfolio balance

Diversifying your real estate portfolio is an effective path to reduce risk.

- Property Types: Mix of residential, commercial, and industrial properties to buffer against market fluctuations.

- Geographic Locations: Investments in multiple regions to minimize the impact of local economic downturns.

- Investment Strategies: A combination of buy-and-hold, fix-and-flip, and rental properties to balance income and growth potential.

Smart diversification of your real estate assets can balance risk and reward. By spreading your risks, you will be protecting yourself from potential downturns.

Developing a strategy as well can reduce volatility and improve the long-term stability of your investments.

Conclusion

By keeping abreast of current trends, seeking out niche markets, using technology, and using sustainable practices, you can position yourself for success in the real estate market. With informed choices and careful risk management, investment opportunities are abundant. Always approach real estate market analysis with a critical mind and forward-thinking strategy.

| Key Point | Brief Description |

|---|---|

| 📈 Economic Indicators | Tracking GDP, interest rates, and unemployment helps forecast market shifts. |

| 🏘️ Demographic Shifts | Understanding generational housing preferences shapes investment choices. |

| 💻 Technological Advances | Digital platforms streamline property management and market access. |

| 🌱 Sustainable Practices | Investing in eco-friendly buildings meets consumer demand and reduces costs. |

FAQ Section

▼

Key indicators include GDP growth, interest rates, and unemployment rates. These metrics provide insights into overall economic health and its impact on the housing market.

▼

Demographic changes influence housing needs. For example, millennials often seek urban living, while baby boomers may downsize, impacting types of properties sought.

▼

Technology provides tools like online listings, virtual tours, and data analytics to improve market access and decision-making for investors.

▼

Consumers increasingly value eco-friendly homes due to environmental awareness and the benefits of energy efficiency, leading to greater market demand.

▼

Diversification, property management, and insurance coverage are vital. These reduce the impact of market fluctuations and protect your investments.

Conclusion

The real estate market offers numerous opportunities for investors who stay informed and adapt to changing conditions. By thoroughly analyzing market trends, understanding demographic influences, and leveraging technological advancements, investors can make strategic decisions that lead to success.