Moving Averages: A Complete Guide for Stock Trading in 2025

Moving averages are a powerful technical analysis tool used to smooth out price data and identify trends in the stock market, helping traders make informed decisions about when to buy or sell.

Navigating the stock market requires an understanding of various analytical tools, and among the most versatile is the moving average. This complete guide to understanding and using moving averages in stock trading will equip you with the knowledge to identify trends, make informed decisions, and potentially enhance your trading strategies.

What Are Moving Averages and Why Use Them?

Moving averages are a fundamental tool in technical analysis. They smooth out price data by creating a constantly updated average price, which can help traders identify prevailing trends and potential support or resistance levels. Understanding how they work is crucial for any aspiring stock trader.

The Basic Concept of Moving Averages

At its core, a moving average is a calculation that takes the average price of a stock over a specific period. This period can be a few days, weeks, months, or even years. The ‘moving’ aspect comes from the fact that as new data becomes available, the calculation shifts forward, incorporating the latest prices and dropping the oldest ones.

By averaging out price fluctuations, moving averages reduce noise and provide a clearer view of the underlying trend. This can be particularly useful in volatile markets where daily price swings might obscure the overall direction.

- ✅ Simplify Price Data: Smooth out short-term fluctuations to highlight long-term trends.

- 📈 Identify Trends: Determine whether a stock is trending up, down, or sideways.

- 🛡️ Reduce Noise: Filter out insignificant price movements that can lead to false signals.

The choice of the period used in the moving average calculation depends on the trader’s objectives. Short-term traders might use shorter periods to capture quick price movements, while long-term investors might opt for longer periods to focus on broader market trends.

Types of Moving Averages: Simple vs. Exponential

While the basic concept is the same, there are different types of moving averages that weight price data in various ways. The two most common types are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). Each has its own strengths and weaknesses, making them suitable for different trading strategies and market conditions.

Simple Moving Average (SMA)

The Simple Moving Average is the most straightforward type of moving average. It calculates the average price by summing up the prices over a specific period and dividing by the number of periods. For example, a 50-day SMA adds up the closing prices of the last 50 days and divides by 50.

While easy to calculate and understand, the SMA gives equal weight to all prices within the period. This can be a disadvantage because it treats recent prices as equally important as older prices, even though recent prices are generally more relevant for predicting future movements.

Exponential Moving Average (EMA)

The Exponential Moving Average addresses some of the limitations of the SMA by giving more weight to recent prices. This means that the EMA reacts more quickly to new information and price changes, making it more sensitive to current market conditions.

The EMA is calculated using a smoothing factor that determines how much weight is given to the most recent price. A higher smoothing factor results in a more responsive EMA, while a lower factor makes it smoother and less sensitive.

- ⚡ Responsiveness: EMA reacts faster to price changes compared to SMA.

- ⚖️ Weighting: More weight given to recent prices, making it more relevant.

- 🛠️ Smoothing Factor: Adjustable to fine-tune sensitivity.

Choosing between SMA and EMA depends on your trading style and objectives. If you prefer a smoother indicator that filters out short-term noise, the SMA might be a better choice. If you want an indicator that reacts quickly to price changes, the EMA might be more suitable.

Moving averages come in two different forms, simple moving average (SMA) and exponential moving average (EMA). The simple moving average takes a specific amount of data and averages it within a given period, whereas an exponential moving average gives recent data more weighting than data from earlier in the data series.

How to Calculate Moving Averages

Calculating moving averages is a fundamental aspect of technical analysis. Whether you’re using a Simple Moving Average (SMA) or an Exponential Moving Average (EMA), understanding the underlying calculations can help you appreciate the nuances of each type and use them more effectively in your trading strategies.

Calculating the Simple Moving Average (SMA)

The SMA is the most straightforward type of moving average to calculate. It involves summing up the closing prices for a specific number of periods and then dividing by that number. The formula for the SMA is quite simple:

SMA = (Sum of Closing Prices for N periods)/N

Where N is the number of periods (e.g., days, weeks, months). To illustrate, let’s calculate a 5-day SMA for a stock with the following closing prices:

Day 1: $10\

Day 2: $12\

Day 3: $13\

Day 4: $11\

Day 5: $14

The 5-day SMA would be calculated as ($10 + $12 + $13 + $11 + $14)/5 = $12.

Calculating the Exponential Moving Average (EMA)

The EMA gives more weight to recent prices, making it more responsive to new information. The calculation of the EMA involves a smoothing factor (α) that determines how much weight is given to the most recent price. The formula for the EMA is:

EMA = (Closing Price * α) + (Previous EMA * (1 – α))

Where α = 2 / (N + 1), and N is the number of periods. Let’s continue the example above to calculate the EMA.

First, calculate the smoothing factor (α) for a 5-day EMA:\

α = 2 / (5 + 1) = 0.333

- ✖️ SMA: Sum of prices divided by the number of periods.

- ➗ EMA: Uses a smoothing factor to weight recent prices more heavily.

- 📈 Significance: Understanding calculations helps in effective strategy use

If there is no previous EMA available, you can start with the SMA as the initial EMA value. Once you have the previous EMA, you can apply the formula to calculate the current EMA using the latest closing price.

By understanding the calculations behind SMA and EMA, traders can better interpret the signals generated by these indicators and fine-tune their trading strategies for optimal results.

Using Moving Averages to Identify Trends

One of the primary uses of moving averages is to identify trends in the stock market. By smoothing out price data, moving averages allow traders to see the overall direction in which a stock is moving, which can be invaluable for making informed trading decisions. Recognizing these trends early can significantly improve your trading outcomes.

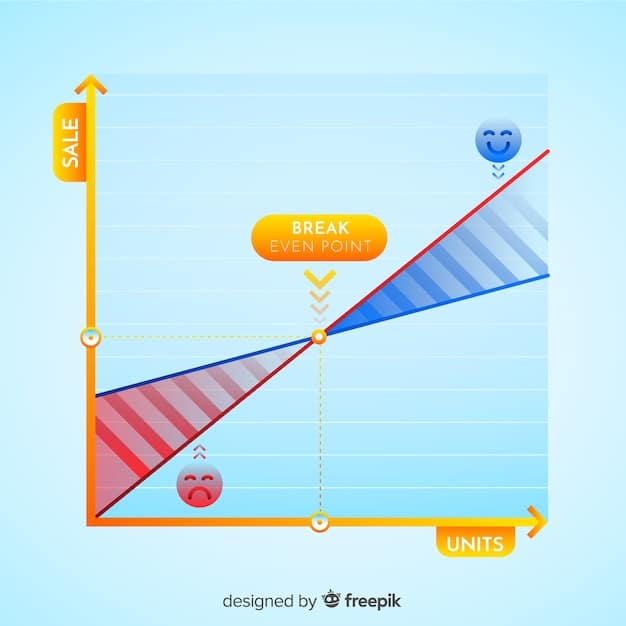

Identifying Uptrends

An uptrend occurs when a stock is consistently making higher highs and higher lows. In this scenario, the moving average will typically slope upwards, indicating that prices are, on average, increasing over time. Traders often look for opportunities to buy when a stock is in an uptrend, aiming to profit from further price appreciation.

When the stock price is consistently above the moving average, it confirms the uptrend, providing a bullish signal. Conversely, if the price dips below the moving average but quickly recovers, it can be viewed as a buying opportunity, assuming the overall uptrend remains intact.

A downtrend occurs when a stock is consistently making lower highs and lower lows. In this case, the moving average will typically slope downwards, indicating that prices are, on average, decreasing over time. Traders may look for opportunities to sell or short-sell when a stock is in a downtrend, anticipating further price declines.

When the stock price remains consistently below the moving average, it confirms the downtrend, providing a bearish signal. If the price rises above the moving average but quickly reverses, it can be seen as a selling or short-selling opportunity, as long as the overall downtrend continues.

Moving Average Crossovers

Another key application of moving averages is identifying potential trend changes through crossovers. A moving average crossover occurs when two moving averages with different periods intersect each other. The most common types of crossovers involve a shorter-period moving average crossing above or below a longer-period moving average.

- ⬆️ Uptrend: Moving average slopes upward, prices consistently above.

- ⬇️ Downtrend: Moving average slopes downward, prices consistently below.

- 🔄 Crossovers: Shorter MA crosses longer MA, indicating potential trend change.

A golden cross occurs when a shorter-period moving average crosses above a longer-period moving average. This is often seen as a bullish signal, suggesting that an uptrend is likely to develop. Conversely, a death cross occurs when a shorter-period moving average crosses below a longer-period moving average, indicating a potential downtrend.

By using moving averages to identify trends and potential trend changes, traders can improve their timing and increase their chances of success in the stock market.

Moving Averages as Support and Resistance

In addition to identifying trends, moving averages can also act as dynamic support and resistance levels. These levels are not static like horizontal support and resistance lines; instead, they move along with the price action, providing potential areas where the price might find support during a downtrend or resistance during an uptrend. Understanding how moving averages function as support and resistance can significantly enhance your trading strategy.

Moving Averages as Support

During an uptrend, the moving average often acts as a support level. This means that as the price dips, it is likely to find support at or near the moving average line, potentially bouncing back upwards. This is because many traders view the moving average as a representation of the stock’s average price, and they are willing to buy when the price approaches this level.

Shorter-term moving averages (e.g., 20-day or 50-day) tend to provide support for short-term uptrends, while longer-term moving averages (e.g., 200-day) can offer support for more extended uptrends. Watching how the price interacts with these moving averages can offer clues about the strength and sustainability of the uptrend.

Moving Averages as Resistance

During a downtrend, the moving average often acts as a resistance level. This means that as the price rises, it is likely to encounter resistance at or near the moving average line, potentially reversing back downwards. This occurs because traders may view the moving average as a ceiling, and they are willing to sell when the price approaches this level.

Similar to support, shorter-term moving averages tend to provide resistance for short-term downtrends, while longer-term moving averages offer resistance for more sustained downtrends. The more times the price has bounced off a particular moving average, the stronger that resistance level is likely to be.

- 🛡️ Support: During uptrends, MA acts as a level where price bounces back.

- 🛑 Resistance: During downtrends, MA acts as a ceiling for price increases.

- ⏳ Dynamic: MA support and resistance changes with price movement.

It is important to note that moving averages are not foolproof support and resistance levels. Prices can sometimes break through these levels, especially during periods of high volatility or significant news events. Therefore, it’s best to use moving averages in conjunction with other technical indicators and chart patterns to confirm potential support and resistance areas.

In summary, moving averages provide valuable insights into potential support and resistance levels. By understanding how prices interact with these dynamic levels, traders can make more informed decisions about when to buy, sell, or hold a stock.

Combining Moving Averages with Other Indicators

While moving averages are a powerful tool on their own, they can be even more effective when combined with other technical indicators. This approach, known as confluence, involves looking for multiple signals that confirm each other, increasing the probability of a successful trade. Combining moving averages with indicators like RSI, MACD, and volume analysis can provide a more comprehensive view of the market.

Moving Averages and the Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. Combining RSI with moving averages can help traders identify potential entry and exit points.

If the moving average indicates an uptrend and the RSI is below 30 (indicating an oversold condition), it could signal a good buying opportunity. Conversely, if the moving average indicates a downtrend and the RSI is above 70 (indicating an overbought condition), it could signal a good selling opportunity.

Moving Averages and the Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD can be used to identify potential trend changes, as well as overbought and oversold conditions.

When the MACD line crosses above the signal line, it generates a bullish signal, which is even stronger if the stock price is above its moving average. Similarly, when the MACD line crosses below the signal line, it generates a bearish signal, which is reinforced if the stock price is below its moving average. In this case, the moving averages can serve as valuable filters, helping traders avoid false signals and focus on higher-probability setups.

- 🤝 RSI: Confirm MA trends with overbought/oversold conditions.

- 📈 MACD: Validate MA trend changes using MACD crossovers.

- 🚥 Volume: Support MA signals with high or low trading volume.

By confirming signals from moving averages with other indicators, traders can increase their confidence in their trading decisions and improve their overall performance. However, it’s important to remember that no indicator is perfect, and it’s always wise to manage risk and use stop-loss orders to protect your capital.

By combining moving averages with other technical indicators, traders can gain a more comprehensive and reliable view of the market. This holistic approach increases the likelihood of making informed decisions and improving trading outcomes.

Practical Trading Strategies Using Moving Averages

Having explored the various aspects of moving averages, it’s time to delve into some practical trading strategies. These strategies are designed to help you apply your knowledge of moving averages to real-world trading scenarios, potentially enhancing your profitability and risk management.

| Key Point | Brief Description |

|---|---|

| 📈 Trend Identification | Moving averages help smooth price data to identify uptrends and downtrends. |

| ⚡ SMA vs. EMA | SMA gives equal weight to all prices, while EMA prioritizes recent prices for faster response. |

| 🛡️ Support & Resistance | Moving averages can act as dynamic support during uptrends and resistance during downtrends. |

| 🤝 Combining Indicators | Using moving averages with RSI or MACD can provide stronger trading signals. |

Frequently Asked Questions

▼

The best period depends on your trading style. Short-term traders may use 20-day MAs, while long-term investors may prefer 200-day MAs.

▼

A short-term MA crossing above a long-term MA is a bullish signal; a cross below signals bearish potential.

▼

No, moving averages do not predict. They smooth out past price data and highlight potential support and resistance areas.

▼

Moving averages are most effective in trending markets. In choppy or sideways markets, they may generate false signals.

▼

SMA gives equal weight to all prices in the period, while EMA gives greater weight to more recent prices, making it more responsive.

Conclusion

Mastering moving averages is a significant step toward becoming a proficient stock trader. By understanding the different types of moving averages, how to calculate them, and how to combine them with other indicators, you can develop robust trading strategies that align with your financial goals. Remember to continuously refine your approach and always manage risk effectively.