How to Identify & Profit from Stock Market Trends: A Practical Guide

Identifying and profiting from stock market trends involves understanding market dynamics, utilizing technical and fundamental analysis, and employing risk management strategies to capitalize on upward or downward movements, ultimately enhancing investment returns.

Navigating the stock market can feel like sailing uncharted waters, but understanding market trends offers a compass to guide your investment decisions. This guide, how to identify and profit from stock market trends: a practical guide, will equip you with the knowledge and tools to recognize, analyze, and capitalize on these trends, turning market fluctuations into profitable opportunities.

Understanding Stock Market Trends

Stock market trends are the general direction in which prices are moving over a period of time. These trends can be upward (bullish), downward (bearish), or sideways (ranging). Recognizing these trends is the first step toward making informed investment decisions.

Types of Market Trends

Market trends can be classified based on their duration and direction. Understanding these categories helps in tailoring your investment strategy.

- Uptrend (Bullish): Characterized by higher highs and higher lows, indicating sustained positive momentum.

- Downtrend (Bearish): Marked by lower highs and lower lows, showing consistent negative momentum.

- Sideways Trend (Ranging): Prices fluctuate within a defined range, showing no clear upward or downward direction.

Why Identify Market Trends?

Identifying market trends allows investors to align their strategies with the prevailing market direction, increasing the likelihood of profitable trades and minimizing potential losses. It also helps in making informed decisions about when to buy, sell, or hold assets.

Furthermore, recognizing trends enables investors to anticipate potential market shifts and adjust their portfolios accordingly, enhancing their ability to navigate market volatility and achieve long-term financial goals. Ignoring market trends can lead to missed opportunities and increased risk.

In conclusion, understanding stock market trends is crucial for making informed investment decisions and maximizing potential returns. By recognizing the different types of trends and their implications, investors can develop strategies that align with the market’s direction and navigate fluctuations effectively.

Technical Analysis for Trend Identification

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. It is used to identify potential trading opportunities and forecast the direction of future price movements by studying patterns and trends.

Key Technical Indicators

Technical indicators are mathematical calculations based on historical price and volume data. They provide insights into market sentiment, momentum, and potential trend reversals.

- Moving Averages (MA): Smooth out price data to identify the direction of the trend. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

- Moving Average Convergence Divergence (MACD): Shows the relationship between two moving averages of a security’s price, highlighting potential buying or selling signals.

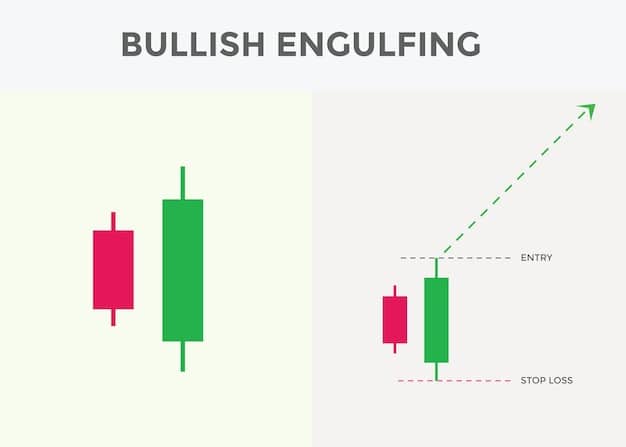

Chart Patterns

Chart patterns are visual formations on price charts that suggest future price movements based on historical data. Recognizing these patterns can help traders make informed decisions.

For example, the “head and shoulders” pattern is a bearish reversal pattern that indicates a potential shift from an uptrend to a downtrend. Conversely, the “inverse head and shoulders” pattern is a bullish reversal pattern that suggests a potential shift from a downtrend to an uptrend.

In summary, technical analysis is an invaluable tool for identifying and validating stock market trends. By using technical indicators and recognizing chart patterns, investors can gain a competitive edge and make more informed trading decisions, ultimately improving their profitability.

Fundamental Analysis and Trend Confirmation

While technical analysis focuses on price and volume data, fundamental analysis evaluates the intrinsic value of a security by examining economic, financial, and industry factors. Combining both approaches provides a comprehensive view of market trends.

Economic Indicators

Economic indicators provide insights into the overall health of the economy, which can influence stock market trends. Monitoring these indicators helps in understanding the macroeconomic environment.

- GDP Growth: Indicates the rate at which the economy is expanding or contracting.

- Inflation Rate: Measures the rate at which prices are rising, impacting corporate earnings and consumer spending.

- Interest Rates: Influenced by central banks, affecting borrowing costs and investment returns.

Company Financials

Analyzing a company’s financial statements provides insights into its profitability, solvency, and growth potential. Key metrics such as revenue, earnings, and debt levels can indicate the company’s ability to thrive in a changing market environment.

Furthermore, examining a company’s management effectiveness and competitive positioning within its industry provides additional context for assessing its long-term prospects. Companies with strong financial health and competitive advantages are more likely to sustain upward trends.

In conclusion, fundamental analysis is essential for confirming and supporting trends identified through technical analysis. By examining economic indicators and company financials, investors can gain a deeper understanding of the forces driving market movements and make more informed investment decisions, enhancing their potential for long-term success.

Tools and Platforms for Trend Analysis

To effectively identify and profit from stock market trends, investors need access to reliable tools and platforms that provide real-time data, analytical capabilities, and trading resources. Selecting the right tools can significantly enhance your ability to make informed decisions.

Trading Software

Trading software platforms offer a wide range of features, including charting tools, technical indicators, and order execution capabilities. These platforms are essential for traders who actively monitor and trade market trends.

Popular trading software platforms include Thinkorswim, MetaTrader, and TradingView. These platforms provide advanced charting tools, customizable indicators, and the ability to backtest trading strategies, offering a comprehensive suite of resources for both novice and experienced traders.

Financial News and Data Sources

Staying informed about market news and economic data is crucial for understanding the factors driving stock market trends. Reputable financial news sources provide up-to-date information and expert analysis.

- Bloomberg: Offers comprehensive financial news, data, and analysis across global markets.

- Reuters: Provides real-time news, insights, and market commentary.

- MarketWatch: Delivers market data, financial news, and investment advice.

In summary, choosing the right tools and platforms is essential for effective trend analysis. By leveraging trading software and staying informed with reliable financial news sources, investors can enhance their ability to identify and capitalize on stock market trends, improving their overall investment performance.

Risk Management Strategies for Trend Trading

While identifying and profiting from stock market trends can be rewarding, it is essential to implement robust risk management strategies to protect your capital and minimize potential losses. Effective risk management is a cornerstone of successful trend trading.

Setting Stop-Loss Orders

A stop-loss order is an order placed with a broker to buy or sell a security when it reaches a certain price. Stop-loss orders are designed to limit an investor’s loss on a position.

By setting stop-loss orders, traders can define the maximum amount they are willing to lose on a trade. This strategy helps prevent significant losses in the event of unexpected market movements. Trailing stop-loss orders, which adjust as the price moves in a favorable direction, are particularly useful for capturing profits while limiting downside risk.

Position Sizing

Position sizing involves determining the appropriate amount of capital to allocate to each trade. Adequate position sizing is crucial for balancing risk and reward.

For example, the 1% rule suggests risking no more than 1% of your trading capital on any single trade. This approach helps prevent a single trade from significantly impacting your overall portfolio. Adjusting position sizes based on market volatility and personal risk tolerance can further refine this strategy.

In conclusion, implementing effective risk management strategies is essential for successful trend trading. By setting stop-loss orders and utilizing appropriate position sizing techniques, investors can protect their capital and navigate market volatility with greater confidence, increasing their chances of achieving long-term profitability.

Psychological Aspects of Trend Following

Successful trend following is not just about technical skills and analytical tools; it also requires a strong understanding of the psychological aspects of trading. Managing emotions and maintaining discipline are critical for executing trend-following strategies effectively.

Overcoming Fear and Greed

Fear and greed are two powerful emotions that can cloud judgment and lead to impulsive decisions. Overcoming these emotions is essential for sticking to your trading plan.

- Fear of Missing Out (FOMO): Can lead to entering trades based on hype rather than careful analysis.

- Greed: Can lead to holding onto winning trades for too long, risking potential reversals.

- Fear of Loss: Can lead to exiting trades prematurely, missing out on potential profits.

Maintaining Discipline

Discipline involves adhering to your trading plan, regardless of short-term market fluctuations. It requires patience, consistency, and the ability to resist impulsive actions.

For example, sticking to predefined entry and exit rules, even during periods of high volatility, helps ensure consistent execution of your trading strategy. Regularly reviewing and adjusting your trading plan based on performance data, rather than emotional impulses, can further enhance your discipline and improve overall trading outcomes.

In summary, understanding and managing the psychological aspects of trend following is essential for long-term success. By overcoming fear and greed and maintaining discipline, investors can execute their trading plans effectively and navigate the emotional challenges of the stock market with greater composure, increasing their chances of achieving consistent profitability.

| Key Point | Brief Description |

|---|---|

| 📈 Market Trends | Distinguish between uptrends, downtrends, and sideways trends to align investment strategies. |

| 📊 Technical Analysis | Utilize indicators like Moving Averages and RSI to identify potential trading opportunities. |

| 🏦 Economic Indicators | Monitor GDP growth, inflation, and interest rates for macroeconomic insight. |

| 🛡️ Risk Management | Implement stop-loss orders and appropriate position sizing to protect capital. |

FAQ Section

▼

The main types of stock market trends include uptrends (bullish), downtrends (bearish), and sideways trends (ranging). Uptrends are characterized by higher highs and higher lows, while downtrends show lower highs and lower lows. Sideways trends involve price fluctuations within a specific range.

▼

Technical analysis uses historical price and volume data to identify patterns and trends. Indicators like moving averages, RSI, and MACD can provide insights into market sentiment and potential trend reversals. Chart patterns also help in predicting future price movements.

▼

Fundamental analysis evaluates the intrinsic value of a security by examining economic indicators and company financials. It confirms trends identified through technical analysis by assessing factors like GDP growth, inflation rates, and company profitability, providing a comprehensive market view.

▼

Essential risk management strategies include setting stop-loss orders to limit potential losses and using appropriate position sizing to balance risk and reward. These strategies protect capital and minimize the impact of unexpected market movements on the portfolio.

▼

Psychological factors like fear and greed can significantly impact trend following. Overcoming these emotions and maintaining discipline are crucial for adhering to your trading plan and making rational decisions, which is vital for consistent execution and profitability.

Conclusion

In conclusion, mastering the art of identifying and profiting from stock market trends requires a blend of technical analysis, fundamental analysis, and disciplined risk management. By understanding market dynamics, utilizing the right tools, and managing your emotions, you can navigate the complexities of the stock market and enhance your potential for long-term success.